Introduction

Have you ever noticed the line item

on your monthly Ontario hydro bill called

the “Debt Retirement Charge”?

This charge is not large- perhaps $2 to $15

a month - so who cares? - We can spend that

on lunch and the bill has to get paid anyway

if you want to keep the lights on. Well, it

is not exactly as advertised and adds up to

billions of dollars for the Provincial

treasury.

We returned to Ontario in 2002 after six

years in Alberta. The world in Ottawa had

changed; cities had merged, Ontario Hydro

ceased to exist and Hydro Ottawa was newly

created. Recall viewing our first hydro

bill and noting the “Debt

Retirement Charge” and

thinking - what debt - whose debt – what’s

that all about? The questions remained

parked until now.

With retirement time on my hands I explored

hydro debt retirement. The journey has not

been unlike Alice in Wonderland and a little

like visiting the Land of Oz.

Like many things government, it’s

complicated. So apologies in advance. This

is a little long involving language all its

own. If you want the short story go to the

end. Here is what I found.

Why the

Debt Retirement Charge?

One has to go back to the future to

understand the “Debt Retirement Charge”

(DRC). The journey begins in 1997 and the

last days of Ontario Hydro. After study by

experts, restructuring of the hydro system

was set in motion through provincial law – Energy

Competition Act which included the Ontario

Energy Board Act and the Electricity Act,

1998. Two significant aspects of

restructuring were:

-

The creation of competitive wholesale and retail markets for electricity

that opened May 2002; and

-

The breakup of Ontario Hydro into five successor entities (companies) on

April 1, 1999; namely:

-

Ontario Power Generation (OPG) Inc. for electricity generation

(wholly owned by the Province);

-

Hydro One for wholesale power transmission and retail distribution

(owned by the Province);

-

The Electrical Safety Authority (ESA) for electrical inspection

(agency of the Province)

-

The Independent Electricity System Operator (agency of the Province)

to manage the power grid and the wholesale electricity market. IESO**

is a not-for-profit, non-taxable corporation that in 2007 was also

designated by regulation as the Smart Metering Entity (SME) pursuant to

the Electricity Act, 1998; and

-

The Ontario Electricity Financial Corporation (agency of the

Province) to manage the legacy debt and other liabilities not

transferred from Ontario Hydro to successor companies. This entity and

the matter of stranded debt is the focus of this article.

**Foot note: Pursuant to provincial

legislation in July 2014 amending the

Electricity Act, 1998, the IESO and the Ontario Power Authority

(OPA) were amalgamated and continue as the

IESO effective January 1, 2015.

Among the objectives of the OPA was

(is) to forecast electricity demand and

adequacy & reliability of electricity

resources, planning for electricity

generation, and promoting the use of cleaner

energy sources and electricity conservation.

The OPA was first established 10 years

earlier pursuant to the

Electricity Restructuring Act, 2004.

All to say, the hydro system has been

undergoing a series of changes over the past

15 years.

The intent of restructuring in 1999 was to

have the new entities operate in a

commercial manner, with a strong financial

footing that would make them

more efficient and

effective and lead

to prices that were as low as possible for

consumers. Successor companies would not be

burdened with all the debt of Ontario Hydro

that tried to set prices that ensured all

costs, including principal and interest

payments on debt, were eventually recovered

from customers.

In short, the DRC is one consequence of a

public policy decision to restructure the

hydro industry and promote a competitive

market place. In the process, liabilities

of old Ontario Hydro were “stranded”

and to be paid off and not written off. For

this purpose, as of 1 April 1999, Ontario

Hydro continued as the Ontario Electricity

Financial Corporation (OEFC). OEFC is an

agent of the Province - a statutory,

non-share capital company for servicing and

retiring Ontario Hydro’s debt and managing

certain other assets and liabilities

emerging out of restructuring. We are now

fifteen years down the road.

It is worth clarifying that the

restructuring was something done on paper –

new organizational structures and means for

paying debt. It had nothing to do with

re-engineering or changing hydro

infrastructure itself – just the entities

that own and run various parts of the system

and allowing free or competitive market.

With the “demerger” of Ontario Hydro,

players are more numerous but are all still

within the government house or sphere of

influence.

Creation

of “Stranded Debt”

Ontario Hydro created a Demerger

Project Office with some 800 separate

project activities involving thousands of

employees to manage a seamless transition to

a new order with no disruption of service.

One of the key considerations was “optimizing

the repayment of the provincially backed

Ontario Hydro debt.”

As a part of restructuring, the Ontario

Electricity Financial Corporation (OEFC) was

created and given the responsibility to

manage the legacy debt of the old Ontario

Hydro (OH), along with certain other

liabilities not transferred to Hydro One and

the Ontario Power Group (OPG).

The Electricity Act, 1998 defines

stranded debt as the debts and other

liabilities of the Financial Corporation

(OEFC) that, in the opinion of the Minister

of Finance, cannot be reasonably be serviced

and retired in a competitive electricity

market (“dette

unsurmontable”). So in a way, the

stranded debt is whatever the Minister says

it was or is in relation to whether it can

be paid or not. Table 1 shows how “stranded

debt’ was calculated and created at

the dawn of a new century.

Table 1 –

Financial impact of restructuring - stranded

debt ($ billion)

Sources:

2014 OEFC Annual Report, 2011 Report

of the Auditor General of Ontario as based

on Ministry of Finance data.

|

Former

Ontario Hydro total debt

|

30.5

|

|

add

|

|

|

Former

Ontario Hydro other liabilities

|

7.6

|

|

equals

|

|

|

Former

Ontario Hydro total debt & other

liabilities

|

38.1

|

|

less

|

|

|

Fair

market value of successor companies

|

17.2

|

|

equals

|

|

|

Initial

stranded debt

|

20.9

|

|

less

|

|

|

Subsequent

adjustment for additional assets

|

1.5

|

|

equals

|

|

|

Adjusted

stranded debt of OEFC – April 1,

1999

|

19.4

|

The OEFC inherited approximately $38.1

billion in total debt and other liabilities

of Ontario Hydro (OH). Less than half of

this was supported by the “fair market

value” of OH assets transferred to successor

companies. It appears successor companies

did not pay for the assets transferred to

them. On April 1, 1999 the OEFC took back

$17.4 billion in interest bearing notes and

loans receivable (assets) in exchange. This

arrangement for stranded debt gave successor

companies a fresh start so they might

compete in a free market where apparently

Ontario Hydro, as a monopoly, could not.

Interestingly, in its final Annual Report of

March 1999, Ontario Hydro stressed its focus

had always been on safety, reliability,

service and

competitive prices. It had a closing

accumulated deficit of $2.7 billion after

corporate write offs in 1997 of $6.6

billion, weathering additional costs of the

once in a hundred years ice storm, and

providing $4.5 billion in future costs

(among its liabilities). Its assets were

$39.6 billion with total liabilities of

$42.3 billion including long term debt of

$27.7 billion. So Ontario Hydro did not

seem to be doing too bad overall. However,

I digress - back to stranded debt.

The remaining $20.9 billion not supported by

the fair value of Ontario Hydro assets of

Ontario Hydro. Additional assets of $1.5

billion came along and reduced the stranded

debt to $19.4 billion.

In short, the DRC is a consequence of a

public policy decision to restructure the

hydro industry and promote a competitive

market place. In the process, liabilities

of old Ontario Hydro were “stranded” by

about $20 billion. This was to be “retired”

and not written off. This is where the debt

retirement charge comes in.

The

Provincial Plan to Retire Stranded Debt

The

Provincial government put in place a

long-term plan (now 15 years down the road)

to service and retire stranded debt. The

plan was to eliminate the stranded debt by

sharing the burden between the electricity

sector and electricity consumers. The plan

included three dedicated revenue streams to

OEFC for paying down the stranded debt:

-

The estimated

present value of future “payments

in lieu of taxes” (PIL) from

electricity sector companies (OPG and

Hydro One and municipal electrical

utilities);

-

The estimated

present value of “cumulative

annual combined profits” of OPG

and Hydro One (owned by the Province) in

excess of $520 million a year (being the

then annual interest cost of the

government’s investment in the two

companies); and

-

The Debt

Retirement Charge to cover the “residual

stranded debt” – being the

initial stranded debt remaining after

deducting the total estimated value of

the two above future revenue streams

(i.e. $20.9B minus $13.1B = $7.8B

starting residual stranded debt). More

on this later.

The first two represent revenue streams

otherwise flowing to the Province (but

diverted to its agency the OEFC). The

Province’s investment return was shielded

from paying stranded debt. The Debt

Retirement Charge (DRC) is revenue coming

from hydro consumers (external to

government) in hard currency in real time.

The other two revenue streams are in the

government house sort of speak.

I was unable to determine if the plan had a

target for when the stranded debt would be

gone. Now a closer look at the DRC and

something called “Residual Stranded Debt”.

What is

the Debt Retirement Charge?

The Debt

Retirement Charge (DRC) is a charge payable

on electricity consumed in Ontario. That

means most anyone using electricity

(residences, business, hospitals, schools).

DRC is authorized by Provincial law and

began in 2002.

According

to an Ontario Guide, DRC is to

replace a portion of debt servicing costs

previously included as part of electricity

bills prior to restructuring of the former

Ontario Hydro. DRC is to end when the “residual

stranded debt” of the former

Ontario Hydro is “defeased”.

Defeased is a word I had to look up. It

does not check out on Microsoft Thesaurus.

The word “defeasible” is in the Oxford

Dictionary (but not defeased) and means open

to revision, valid objection, forfeiture or

annulment. As far as I can tell, no debt is

objected or forfeited.

According to google defeased (defeasance/

defeasement) is a commercial or legal term

with various meanings. One meaning is a

provision that voids a bond or loan when the

borrower sets aside cash or bonds sufficient

to service the borrower’s debt. This sounds

like paying interest only and not retiring a

debt. There are other descriptions of

“defeased” but none reflect an ordinary

understanding of paying a debt i.e. paying

principal and interest. Residual

stranded debt is explained later. It’s a

mind bender too.

Am now

beginning to wonder if DRC is a misnomer.

Maybe it is more accurately called the

“Liability Defeasement Charge”. But

imagine that appearing on a hydro bill and

people not scratching their heads (if they

notice the DRC at all).

DRC is

paid by almost all electricity users in

Ontario. There are exceptions such as Status

Indians and Indian bands purchasing

electricity consumed on a reserve and

self-generating users eligible for station

service exemption or an annual exemption by

the Province.

DRC is applied at

a rate of 0.7 cents per kilowatt hour (KWH)

with the exception of reduced rates in

certain listed service areas of local

utilities as existed on October 30, 1998.

There are 19 areas paying lower DRC rates

from 0.0 cents to 0.69 cents per KWH. No

comment.

All distributors and

retailers required to be licensed by the

Ontario Energy Board (OEB) must register as

DRC collectors. The money is sent by

collectors to the OEFC and not the OEB. The

OEB is the regulator of Ontario’s natural

gas and electricity industries and provides

advice on energy matters referred to it by

the Minister of Energy and the Minister of

Natural Resources. Like the OEFC, the OEB

is an agent of Her Majesty in right of

Ontario and exempted from federal and

provincial income taxes.

What is Residual

Stranded Debt?

Residual

Stranded Debt (RSD) is important because the

DRC remains until that is gone. RSD is the

amount remaining in stranded debt after

estimating future revenue streams other than

the DRC for paying the stranded debt. Said

another way, the RSD is the estimated

portion of the stranded debt that could not

be supported by expected future revenue from

electricity companies. The DRC will

cease at some point provided electricity

companies do their part and the RSD does not

increase.

At the beginning, the initial RSD was

estimated at $7.8 billion. This is what

hydro consumers were expected to pay for.

But the RSD is not a fixed amount or sum

certain. It varies in value – a moving

target. The RSD estimate changes each year

as determined by the Minister of Finance.

The important thing to recognize is that if

the other two revenue streams happen to fail

or fall short….then hydro consumers continue

paying the stranded debt.

In response to observation by the Province’s

Auditor General in 2011, the government made

the RSD more transparent by introducing in

2012 a new regulation formally establishing

how the RSD is to be calculated and

requiring annual reporting of the amount in

The Ontario Gazette. Most

Ontarians are likely not even aware of this

service and I doubt if many look up

regulations. Not exactly transparent, but

its’ there if you care to look. I did not

attempt to find out who (if anyone) checks

RSD calculations.

The “retirement” of RSD is subject to

uncertainty in forecasting the future of

OEFC, which depends on the financial

performance of OPG, Hydro One, and municipal

electric utilities, as well as other factors

such as interest rates and electricity

consumption. Which are all, in turn,

dependent on the state of economies and

decisions of others. The RSD and the fate

of the DRC are kind of floating in the air -

subject to the winds of fortune.

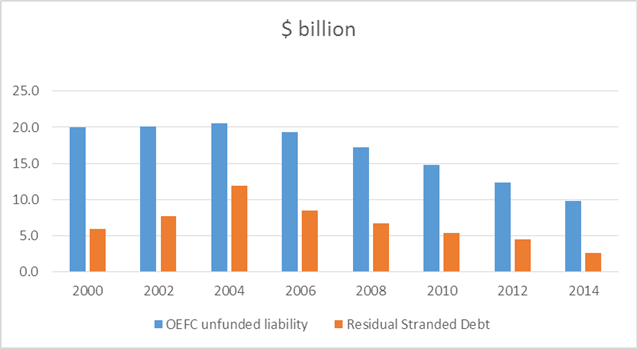

Chart1 below shows the history of the RSD

relative to the “unfunded liability”

of the OEFC.

Now what is unfunded liability? OEFC

considers stranded debt and its unfunded

liabilities (difference between total assets

and all liabilities including debt) to be

one and the same and therefore sees stranded

debt as reduced by half over 15 years; $9.8

billion as at March 31, 2014 compared to

$19.4 billion at March 31, 2000 (end of the

first fiscal year of OEFC). This is

probably technically correct but have not

examined the details of governing

legislation and OEFC conformance therewith.

So now I am wondering if the stranded debt

should have been called “Hydro Unfunded

Liability” and the DRC called the

“Government Unfunded Liability Payment” or

GULP for short. Sorry, I could not resist.

Back to the subject of Residual Stranded

Debt and Chart 1.

Chart 1- History

of Residual Stranded Debt & Unfunded

Liability of OEFC

Source:

OEFC data and annual reports

Note that what is called initial stranded

debt ($20.9B) at April 1, 1999 becomes

“unfunded liability” at March 31, 2000 as

reported by the OEFC.

The RSD has been reducing each year since

2004 when it spiked to $11.9 billion from

the initial estimate of $7.8 billion. Things

were not going in the best direction for

ending the DRC. Fortunately for hydro

customers the RSD has since trended downward

to $2.6 billion as of March 31, 2014.

Remember though, the RSD is not a function

of the DRC except an RSD of $0 is the finish

line for DRC (unless a government of the day

rules otherwise).

How much has OEFC

collected in Debt Retirement Charge?

Dollars a

month become billions. A total of $11.5

billion in DRC revenue has been taken in by

the OEFC to March 31, 2014; between $800

million and $1 B each year for 12 years.

Simple enough. A breakdown between

residential and non-residential is not

available (at least not publicly).

However, the OEFC notes in its financial

statements that the residential rate class

accounts for about a third of electricity

load subject to the DRC with the remainder

of electricity load used by commercial,

institutional and industrial consumers.

That being so and assuming the DRC rate is

constant across all classes, residences paid

about $4 billion in DRC and all others about

$7.5 billion. Of course, the DRC paid by

non-residential hydro users would either be

absorbed or recovered from consumers in the

pricing of their goods and services. There

is no free lunch.

The harder questions are what has DRC money

been used for and has its purpose been

achieved? These questions are examined in

terms of how much debt has been “retired”

and remains as well as what the OEFC spent

revenues on, including the DRC.

What progress has

been made in paying stranded debt?

In writing

this article I should hasten to say I take

the words “debt retirement” on face. I

stick with that at the risk of being seen as

too literal or na´ve. After all, a debt is

a liability. And, a liability of one is an

asset of another. Such is the power of

double entry bookkeeping (debits & credits)

as invented by an Italian monk in the 17th

century.

Table 2 shows what OEFC started with

compared to what it held on March 31, 2014.

The difference between the two gives an idea

of what changed over 15 years.

Table 2:

Changes in OEFC liabilities from

March 2000 to 2014

In $ billion

Source:

OEFC financial statements

|

Balance sheet items of OEFC

|

2000

|

2014

|

Change

|

|

LIABILITIES

|

|

|

|

|

Debt held by the Province (owed

to the Province)

|

9.6

|

19.1

|

+ 9.5

|

|

Debt held by others - guaranteed

by the Province

|

21.7

|

7.0

|

- 14.7

|

|

Total debt

|

31.3

|

26.1

|

- 5.2

|

|

Power purchase contracts (note

2)

|

4.3

|

.7

|

-

3.6

|

|

Nuclear risk funding (note 3)

|

2.5

|

0

|

-

2.5

|

|

Current liabilities (accounts

payable etc.)

|

.8

|

.6

|

- 0.2

|

|

|

|

|

|

|

Total debt and other liabilities

|

38.9

|

27.4

|

- 11.5

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

Notes & loans receivable from

the Province

|

8.9

|

8.9

|

0.0

|

|

Nots & loans receivable from

Ontario Power Group

|

3.4

|

3.9

|

+ 0.4

|

|

Notes & loans receivable from

Hydro One

|

4.8

|

0

|

- 4.8

|

|

Notes & loans receivable from

others

|

.3

|

.2

|

-

0.1

|

|

Total notes & loans receivable

(note 4)

|

17.4

|

13.0

|

- 4.4

|

|

|

|

|

|

|

Electricity sector income due

from Province (see note 5)

|

.3

|

3.9

|

+ 3.6

|

|

Deferred debt costs

|

.9

|

|

- 0.9

|

|

Current assets (cash, accounts

receivable etc.)

|

.3

|

.7

|

-0.4

|

|

|

|

|

|

|

Total Assets

|

18.9

|

17.6

|

- 1.3

|

|

|

|

|

|

|

Unfunded Liability (total

liabilities minus total assets)

|

20.0

|

9.8

|

- 10.2

|

Notes:

-

Debt is

comprised of amounts maturing anywhere

from 1 to 50 years out and are repayable

in various currencies. In 2014 the

effective rate of interest on the debt

was 5.47% (compared to 8.29% in 2000).

-

Power purchase

contracts and support agreements were

inherited by OEFC from Ontario Hydro as

were entered into with Non-Utility

Generators (NUGs). Contracts

provide for the purchase of power from

NUGs in excess of future market price.

The contracts expire on various dates

out to 2048. Accordingly, a liability

was recorded on April 1, 1999 of $4.3

billion on a discounted cash-flow basis

when the former Ontario Hydro continued

as the OEFC. Subsequently, under the

Electricity Restructuring Ac, 2004,

the OEFC began receiving actual contract

prices for power from electricity

consumers and no longer incurs losses on

these contracts. As a result, the bulk

of the liability would be eliminated

and is being amortized to revenue over

12 years (see Table 3 and subsequent

analysis).

-

Nuclear risk

funding represent a liability arising

from nuclear waste management and asset

removal.

-

As established

by the stranded debt retirement plan,

the Province committed to dedicate the

cumulative combined income of OPG and

Hydro One in excess of the Province’s

interest cost of its investment in its

electricity subsidiaries. The Province

recoups all interest on its investments

before any income can be recognized by

OEFC. The $3.9 billion represents the

cumulative amount due from the Province

each year after deducting the Province’s

$520 million interest cost of its

investment in OPG and Hydro One.

-

Readers are

encouraged to view OEFC annual reports

(available on line) to get more

information.

Some things to

observe from Table 2:

-

Who holds the

stranded debt has shifted. Most of the

stranded debt is now held by – owed to -

the Province. The Province holds about

$19.1 billion in debt instruments or

about 70% of total OEFC liabilities. The

rest ($7 billion) is guaranteed by the

Province.

-

There has been

more in debt turnover than retirement –

unless you consider replacement of debt

to be a retirement. The Province has, in

effect, replaced half the debt held by

others. In 2000, Provincial debt

represented 1/3 of total stranded

debt. In 2014 it

accounted for over 2/3 and the Province

still guarantees the debt held by

others. More interest revenue for the

Province.

-

Total debt

is reduced by a reported $5.2 billion

over fifteen years with a further

reduction in other liabilities of $6.3

billion coming from reduction in power

purchase contract liabilities and the

nuclear risk funding liability. The

reduction in power purchase contract

liabilities arises from changes in

legislation (as per note 2 above) and

not from debt payment as such.

In conjunction with

the Ontario Financing Authority (OFA), the

OEFC has renewed/replaced debt as they came

due. Total debt as such has not reduced

substantially over the past fifteen years.

Interestingly, the total long term debt of

the OEFC of $26.1 billion as of March 2014

is almost the same as the long term debt of

the old Ontario Hydro as it was in March

1999 ($27.7 billion). Seems not much is

retired in regard to “debt” per se. See

next section on where the money went.

However, the

unfunded liability of OEFC has dropped by

half (from about $20 billion to $10

billion). On one hand this is good news, on

the other maybe another 15 years to go –

making a 30 year time horizon for dealing

with the financial fall out of hydro

restructuring.

The OFA (also an

agency of the Province) manages the

Province’s debt and borrowing program. The

total debt portfolio of the Province is in

the order of $314.5 billion. The OEFC

has no employees. It is OFA staff doing the

work. The Chief Executive Officer (CEO) of

OFA and OEFC are one and the same person for

the past fifteen years. The Chairmen of the

Board of Directors of both entities is

currently also one and the same, but other

members of each of the two governing Boards

differ as between the OFA and the OEFC.

What happens in the

end – what is the bottom line? Well it

depends on how you look at it and how far

you track the numbers.

Each year, OEFC

financial results are assimilated into

provincial accounts on a line by line basis

when the OEFC accounts are consolidated into

Provincial financial statements (Public

Accounts). So it all comes out in the wash

when reporting Provincial annual deficit and

accumulated deficit. At the end of the

process DRC pops out as “non-tax

revenue” for the Province.

I do not know what

happens to the rest of the numbers. Wouldn’t

it be magic though if amounts offset each

other and the net effect on the accumulated

deficit of the Province is a virtual

zero—except for debt owed to external

parties.

But, I speculate.

How has Debt

Retirement Charge money been used?

To get at

this question, one has to appreciate that

the OEFC engages in a number of activities

beyond retiring stranded debt. Its mandate

and activities include:

-

Managing the

stranded debt portfolio.

-

Managing power

supply contracts and related loan

agreements.

-

Risk managing

debt and derivative financial

instruments.

-

Supporting the

implementation of the Government’s

electricity policies. The OEFC supports

the Industrial Electricity Incentive

(IEI) program by providing payments to

the Ontario Power Authority (OPA) to

offset the cost of the DRC portion of

the electricity bill paid to OEFC on

IEI-eligible incremental consumption by

IEI participants. This is designed to

be cost-neutral for the OEFC. So the

DRC is being compensated for some power

users. It is not clear just how this

works and how much is relieved to IEI

participants.

-

Providing

financial assistance to successor

corporations and supporting new

electricity supply projects. For

example, providing the Ontario Power

Generation (OPG) with financing for new

generation project developments in the

form of 10-year and 30 year notes,

providing for up to $1.6 billion in

loans for the Niagara tunnel project,

providing up to $700 million in support

of OPG’s investment in the Lower

Mattagami project, and providing OPG a

credit facility for up to $500 million

expiring on December 31, 2014 for

general corporate requirements including

the Darlington refurbishment project.

-

Refinancing and

sometimes increasing notes receivable

including, for example, those with the

Independent Electricity System Operator

(IESO).

In an attempt to

show how the DRC has been used, Table 3

shows the total revenues and expenses of the

OEFC over the same fifteen year period as

Table 2.

Table 3 –A

summary of OEFC Revenues & Expenses – 2000

to 2014 in $ million

Source:

OEFC table - not audited

|

REVENUE

|

$ million

|

|

Debt Retirement Charge

|

11,546

|

|

Payments-in-lieu of tax

|

9,185

|

|

Electricity sector dedicated income

|

4,357

|

|

Sub - total of planned revenues for

retiring stranded debt

|

25,088

|

|

Power supply contract recoveries

|

14,224

|

|

Net reduction of power purchase

contracts (see note 2 of Table 2)

|

3,590

|

|

Interest

|

12,385

|

|

Revenue pool residual (ending in

2002-03)

|

2,240

|

|

Gain on sale of Hydro One notes

(2002-03)

|

206

|

|

All other revenue

|

250

|

|

Total revenues from fiscal year

1999-00 to 2013-14

|

57,983

|

|

|

|

|

EXPENSES

|

|

|

Debt interest

|

28,227

|

|

Debt guarantee fee (presume paid to

the Province)

|

2,125

|

|

Interest on nuclear funding

liability (for eight years ending in

2006-07)

|

925

|

|

Electricity Consumer Price

Protection Fund (2003 & 2004 only)

|

918

|

|

Power supply contract costs

|

14,921

|

|

Temporary generation supply (2003-04

only)

|

70

|

|

Amortization of deferred charges

(ending in 2011-12)

|

1,026

|

|

Operating

|

182

|

|

Total expenses from fiscal year

1999-00 to 2013-14

|

48,394

|

|

|

|

|

Excess of Revenues over Expenses

|

9,589

|

|

Unfunded liability of OEFC beginning

|

19,433

|

|

Net adjustments to unfunded

liability (increase)

|

63

|

|

Unfunded liability of OEFC as at

March 31, 2014

|

9,781

|

A few things to note

from Table 3 along with other information:

-

DRC revenue is

comingled with other revenues for the

OEFC to use in meeting all its mandate.

As with other revenue streams, the DRC

is not set aside to service or pay any

debt in particular. The DRC is a

contribution to a pot.

-

Debt retirement

related revenue has not kept pace with

debt related servicing costs. The DRC

revenue ($11.5 billion) plus other

dedicated revenue ($13.5 billion)

intended for retiring stranded debt

total $25 billion. This does not cover

debt interest expense ($28.2 billion)

plus debt guarantee fee ($2.1 billion)

and the nuclear liability interest ($0.9

billion) – expenses totalling $31

billion for servicing debt. So if we

were speaking debt repayment in ordinary

terms (principal and interest), no

amount of principal would be paid down.

If not for other revenues there would be

no reduction in the unfunded liability

of the OEFC.

-

There is money

moving from left to right pockets in

terms of the Province both receiving and

paying interest on amounts due from and

to itself.

-

As the result of

legislative reform in 2004 to the

electricity market, the liability for

estimated future losses ($4.3 billion)

on power purchase contracts as inherited

from old Ontario Hydro is now being

amortized by the OEFC as revenue over a

12 year period since losses are no

longer incurred on power purchase

contracts. This is reflected in the

$3.6 billion of net reduction in power

purchase contracts as reported as

revenue by the OEFC.

-

In regard to

power supply contract costs ($14.9

billion) and recoveries ($14.2 billion)

since 2000. The 2004 legislation

(Electricity Restructuring Act) shifted

the burden of power purchase contract

losses from the OEFC to hydro

ratepayers. Previously, the OEFC

purchased power from the NUGs and sold

the power at market prices lower than

cost, thus incurring losses.

Starting in

January 2005, the OEFC began receiving

actual contract prices for power from

ratepayers thus eliminating losses going

forward on power purchase contracts.

Power supply contract recoveries have

doubled for the OEFC when they averaged

about $600 million a year to 2005 and

now at about $1.3 billion a year.

-

The same Act

also resulted in a combination of

regulated and competitive electricity

sector pricing with different generators

receiving prices set through a variety

of mechanisms. Electricity pricing is

complicated with consumers paying a

blend of costs including pass-through of

regulated prices for OPG’s regulated

plants, the full costs for existing and

new contracts for generation, and spot

market prices for other generation

facilities. This no doubt a complex a

variable pricing structure.

Considering the

foregoing and seeing the total long term

debt of OEFC is almost the same as it was

for the old Ontario Hydro fifteen years

ago….it seems not much has changed regarding

debt proper. Debt as such is still largely

with us. The change is more about other

liabilities and other revenue and expense

streams – in particular regarding power

purchase contract obligations and the flow

of interest in and out.

Coincidently, it is

interesting to note that in its final report

of 1999 the old Ontario Hydro commented (on

page 42) that estimates of stranded debt

were “preliminary” and the actual stranded

debt would be known once a final

determination can be made for other items;

principally valuing power purchase

obligations”. Whether such a final

determination was made I am not certain.

What is clear is that subsequent

legislative changes in 2004 began

eliminating losses on power purchase

contracts and the burden going forward

shifted to ratepayers. Some other form of

liability reduction charge has been

instituted. Just how this works I do not

know.

In the end analysis,

there is no clear answer as to where DRC

money went in particular. DRC is revenue for

the Province and no particular or specific

debt repayment is obvious except to say in

“Toto” debt proper of the OEFC has reduced

by about $5 billion since 1999 and its net

unfunded liability (including debt) reduced

by $10 billion (about half).

Interestingly, while

there is regulation setting out how residual

stranded debt (RSD) is to be calculated and

how the RSD value is to be published each

year, there appears to be nothing requiring

the Minister to periodically state publicly

what the value of the stranded debt is at

any particular time. One could presume or

assume this would be the “unfunded

liability” of the OEFC as shown in Tables 2

and 3 previous.

Permanently retiring

outstanding stranded debt of $26 billion

would entail liquidating assets of the OEFC

and covering any shortfall. Doing so would

be a major policy decision and no doubt not

a simple endeavour. I wonder if anyone has

assessed the option of “calling it a day” on

stranded debt?

The DRC helps defray

costs and reduce unfunded liabilities of the

OEFC – much of which is debt owed to the

Province. One could view this as debt owed

to the people of Ontario in common that is

being paid back or carried by the people of

Ontario as hydro users directly or

indirectly as consumers of goods and

services or as investors in business.

There is good news.

As proposed in the May 2014 Provincial

budget the DRC may come to an end for

residential hydro users after December 2015

– saving a typical homeowner about $70 a

year. However, it is expected to continue

for non-residential users until the end of

2018 when the RSD is anticipated to be

“retired” in full. This could change if the

RSD spikes north as it did in 2004,

especially if the economy goes south. Stay

tuned and keep your fingers crossed

especially since the latest news is about

economic downturn.

All so far

illustrates the consequences of government

decisions are often not known until long

after the decisions are made and those who

made them are long gone. At the same time

we live the consequences of past decisions

and need to learn from the past.

Why HST on DRC?

A final

question. Ok, if debt is being paid, why do

we pay HST on the DRC? By rough

estimation, hydro consumers have paid about

$1.5 billion in sales taxes on top of $11.5

billion in DRC; a total of $13 billion.

The Canadian Revenue

Agency sent information to explain.

Apparently I am the first person in ten

years to ask. It comes down to “based on the

application of subsection 154(2) of the

Excise Tax Act (ETA), the DRC forms part of

the consideration for the supply of

electricity”. As the DRC has not been

prescribed in regulations as an exclusion

and as the supply of electricity is a

taxable supply, GST applies to the value of

the consideration, including the DRC, for

the supply of electricity pursuant to

subsection 165 (1) of the ETA.

Translation - from

the federal perspective, the DRC is revenue

in exchange for services. It’s not debt

payment but a charge for services - as it

was under old Ontario Hydro that sought to

cover all costs in its pricing for

electricity, including paying debt principal

and interest. We are now back to where this

all began.

In Closing

It seems

nothing changed in substance for paying

hydro debt – just the players and method of

payment. From this author’s perspective,

people and enterprises of Ontario are, for

the most part, paying a debt owed to their

own government (i.e. to themselves) and paid

$11.5 billion plus HST in doing so.

The DRC has helped

fund various activities of the Ontario

Electricity Financial Corporation (OEFC) in

carrying out its mandate. Money to retire

debt is comingled with other revenues to

service debt and other liabilities left

behind by the former Ontario Hydro.

While difficult to

comprehend and follow, the DRC is not

necessarily a bad thing and may have helped

produce positive results for the people of

Ontario. It is part of a big picture of

“hydro reform” that deserves clear

accountability and transparency by the

Government of Ontario including whether

reform has been worthwhile especially in

terms of low as possible hydro rates and

debt retirement. A comprehensive evaluation

of results (intended and unintended) could

reveal lessons learned that may inform

future public policy decisions.

The DRC is not what

was first expected and old hydro debt per se

is not significantly retired after 15 years.

However, there has been progress reducing

the combination of debt and other

liabilities of the OEFC.

The deeper question

is – has reform of the hydro system been

successful? What has been achieved for the

public good and are lessons learned? Have

debt retirement dollars been worthwhile?

In doing this

article I learned more about the hydro

system and kind of understand the DRC - but

then again not. I empathize with Alice

and Dorothy and look forward to a

happy ending.

The OEFC was given

the opportunity to comment on a draft of

this article but did not respond. A big

thank you to Doug, Neil, Roseann, Sam, and

Phyllis for their encouragement and review

comments.

Disclaimer: The information used

in this article comes from publicly

available sources. The analysis and

conclusions are those of the author and do

not represent the views of any organization

the author may be associated with.

Related

Articles By This Author:

Need For Transparent Electricity System

in Ontario - Change not only the rates but also the way the system is made transparent to the public.

|